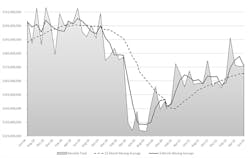

U.S. machine shops and other manufacturers consumed $175.9 million worth of cutting tools during June 2022 – slightly more (0.3%) than during May and 2.2% more than the June 2021 consumption total. The Cutting Tool Market Report tracks cutting-tool consumption as a reliable index to overall manufacturing activity, because cutting tools are a primary consumable product in use across multiple industrial sectors.

Through six months of 2022 activity, consumption of cutting tools has totaled $1.1 billion, which is 7.9% higher than the comparable January-June 2021 figure.

“As we approach the mid-year seasonal slowdown, June’s numbers dropped almost a half of a percentage point from May,” commented Jeff Major, president of the U.S. Cutting Tool Institute. “Our industry continues to endure the many economic challenges brought on by the pandemic.”USCTI and AMT – the Assn. for Manufacturing Technology issue the Cutting Tool Market Report, which is compiled using actual sales figures reported by participating suppliers that represent the majority of the U.S. market for cutting tools.

The “seasonal slowdown” Major identified is also evident in AMT’s recent U.S. Manufacturing Technology Orders report, a forward-looking summary of machine tool demand. While there is a historic pattern of slower manufacturing activity during summer months, demand for cutting tools has been slowing since the start of Q2 2022, pressured by rising inflation and supply-chain disruptions, and reportedly because manufacturers continue to have difficulty filling positions for skilled workers.Christopher Chidzik, principal economist at AMT, suggested that raw material shortages may be another factor slowing cutting-tool consumption. “While (cutting tool) shipments appear to have hit a plateau, the value of those shipments in 2022 are at the highest monthly average since 2019. There is still some way to go before monthly orders match their pre-pandemic levels. Shortages of materials, particularly certain metals, mean there is an upper limit on the number of tools that can currently be used. Shops only need as much tooling as they have metal to work.

“If these challenges can be alleviated and consumer demand for manufactured goods and capital-intensive services remains strong, the second half of 2022 could see monthly order activity return to pre-pandemic levels,” Chidzik added.